China, a market still in Infancy...

Reproduction in English of my article published in issue # 74 (June/July) of Spirito diVino Italia in which in present an alternative way to look at China potential as a consumer market ...

Last April's visit to Vinitaly of Jack Ma, founder of the mighty Chinese e-commerce company Alibaba and second richest man in China has brought to light Italy’s position in China’s wine market as well as its tremendous potential going forward. The reception to his speech brought mixed reviews within the Italian wine industry.

However, after 22 years living in Hong Kong and working in China, I have learned to look at its dynamics with a macroeconomic approach rather than focus too much on the microeconomics of everyday.

Today, without question, China is in a state of flux. Its population is currently in the midst of experiencing an unprecedented speed of urbanization and is seeing an exponential rise in its disposable income. This, in turn, has triggered the current flurry of governmental policies changes that are certain to dramatically transform the country in a not so distant future.

Two factors are certain to shape its future economics. First, between 2000 to 2010, its economy has more than doubled and it is forecasted to continue growing at a rate of 6.9 to 7.9% per year. Second, there is a huge difference in purchasing patterns between rural and urban consumers and today, 60% of its population still lives in rural areas but forecasts predict a dramatically different picture by 2020 when its urban population will account for 60% of its total.

Nevertheless, China is still a developing country and many aspects of its markets remain today mostly primitive, amateurish, and unprofessional. In fact, growth in China has been until now akin to a bubble: extremely steep and undisciplined. It is not surprising therefore that the Chinese government needed to make several adjustments, beginning with the changes in labor laws in 2008 up to its recent anti-corruption drive and austerity measures. All which are geared towards pushing up wages, bringing financial reforms and increase the role of private business into its economy with a focus to normalize markets. The process is not over and China is bound to look dramatically different in 5 to 10 years in comparison to what it looks today.

Through a series of graphics drawn from various researches and consumer surveys conducted by McKinsey & Company since 2005 and supported by recent findings by the Boston Consulting Group and a recent article published in The Economist arguing that, despite news of recent economic slowdown, China’s consumption is resilient, this article aims to draw a pictures of the forces currently at play in China. Forces that will shape the wine industry in years to come and require that we look at China with adifferent paradigm.

The most important picture to understand China in the future is shown in graphic 1. McKinsey & Company forecast that by 2020, the country will have 357 million households in urban areas from about 256 million very recently. Of those, 190 million households, 54% of its urban population, will be in the upper middle-class with an annual disposable income between 16 and 34 thousand USD. That is a sea change from 2012 when its upper middle class was only 49 million households, or a mere 14% of its urban population. To put it all in perspective, Pew Research tells us that in Italy today, 45% of its population is considered middle-class with disposable income between 16 and 29 thousand USD. Graphic 2 emphasizes further the magnitude of China’s upper middle class forecasted for 2020, it will be 7 times larger than that of Japan and 8 times larger than that of Germany!

Graph 1 - China's Upper Middle to be 54% of its Urban Population by 2020

Graph 2 - By 2020, China's Upper Middle Class will be 8 times that of Germany

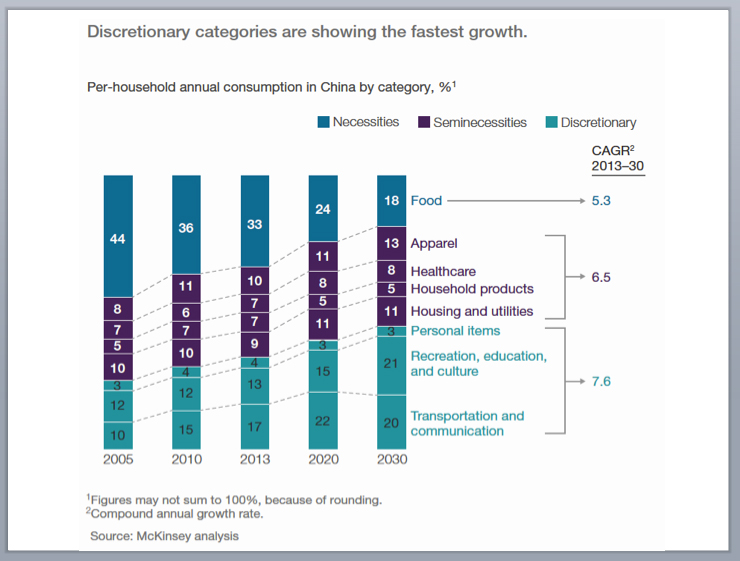

Until now, Chinese households have largely spent on necessities or semi-necessities – on things they needed. Contrastingly, discretionary spending on things they wanted – small luxuries – is increasing rapidly and will continue to rise alongside the increase in discretionary income. As a percentage of total spending, graphic 3 show that in 2005, it was a mere 25% while in 2020 it will reach 40% of total spending.

Grape 3 - Today's Chinese consumers still buy the products they need

Therefore, the key to China’s future markets is the rise of its upper middle class which is only beginning to take effect. It will become the dominant force that will power the engine of consumer spending. Over the next several years, as they make the transition between purchasing for necessity to buying for small luxuries, these consumers will develop new behaviors. McKinsey & Company forecast that by 2020, consumers will continue to be pragmatic but we will see an increasing element of individuality in their purchase decisions. As well, McKinsey identified that consumers will show unusual modernism in their behaviors. From their current habits of low impulse purchase and a high degree of thoughts before buying things, consumers will increasingly look for emotional benefits and will see shopping as entertainment and will seek for new and unique experiences. Trends show that the upper middle class in China today is young, increasingly emotional, willing to pay a premium for quality and most importantly, see their purchase as a way to show success.

The second most important picture (graphic 4) to understand China is that, even though its current middle class is far from having reached its full potential, Chinese consumers were by 2015 the largest buyers of luxury products in the world with a share of global luxury consumption at 34% of total. Key factors for this dominant position are that the very wealthy as a group increase at a rate of 20% per year, this affluent class have a strong tendency to trade up, women have a high purchasing power, there is rapid change in lifestyle and, social gifting is a key characteristic of Chinese culture. The most important aspect of this phenomenon however is that Chinese consumers are globe-trotting shoppers. Surveys show that by 2012, over 60% of luxury consumption was made aboard and this share of purchasing pattern is increasing. By 2015, Chinese consumers will have made 94 million trips overseas. McKinsey & Company forecast that the current situation is far from saturation. The growth of luxury consumption is predicted to continue in the long term alongside the growth of China’s urban population in the upper middle class tier and resulting growth of discretionary income as well as with the increase in overseas travels by Chinese.

Graph 4 - Chinese already accounts for 34% of the world's luxury spend

The third most important picture, graphic 5, is related to online retail sales. Today the highest in the world, it is forecasted to increase at a fast clip over the next several years. In fact, today 38% of Chinese consumers shop online and they are already the world’s most sophisticated internet users. China has a unique digital landscape with a multitude of platforms from online shopping malls, unique social media apps and online payment systems. This savviness is not limited to urban households and extends to the rural population as well. The internet is considered a major source of information and is used as a critical medium to compare prices and obtain referral from friends. Most of its annual spending is now on food but segments with the fastest growth are currently its restaurants, travels, and entertainment showing a clear parallel to the increase in the discretionary income of its middle class.

Graph 5 - Chinese are the most sophisticated e-commerce consumers in the world

Finally, the last picture I want to draw attention to in order to explain China is the map of its consumers (Graphic 6). As we have seen, urbanization is key. From 2012 to 2020, China’s urban population will increase from 256 million households to 357 million households. Already today, there are 200 cities with more than 1 million in population compared to 35 such cities in the EU. However, cities are highly heterogeneous in their consumer purchasing behaviors and China must be seen as a collection of several independent clusters. For example, even though Shenzhen and Guangzhou are only 2 hours drive apart each have its unique and different consumer behaviors. In Shenzhen, its population is young, mandarin speaking, and enjoys drinking at bars but in Guangzhou, its population is older, speaks Cantonese, and enjoy drinking in restaurants. This has tremendous implications for strategies. China must be considered not as one homogenous country but as a constellation of several different countries. By 2020, McKinsey & Company forecast that the highest growth will be in smaller cities located in the north and west of the country. Over the next several years, there will be a major shift of focus from so-called first tier cities like Beijing and Shanghai to 3rd and 4th tier cities like Nanchang and Xian. In fact, forecasts shows that by 2020, tier 1 cities will account for only 16% of the China middle-class, from 40% today.

Graph 6 - China is a constellation of cluster cities

And so, why are the French ahead in the market with Australians and even Chileans making more rapid headways that the Italians? A likely explanation is that the first phase of consumption in China, during a period a very low discretionary income, was characterized by business entertainment and gifting which called for wines of prestige and high reputation. As the discretionary income of China’s middle class is now slowly increasing, the market is currently transiting toward one of consumption of small luxuries and the wine market is now entering a phase that demands value for money as well as accessibility and familiarity to untrained palates. It is therefore normal that Cabernet Sauvignon and Merlot from Australia and Chile would do well at this time in China. The next phase, surely by 2020 when there will be a larger base of consumers with experience of drinking wine, the market will enter a phase of experimentation. This will be when the wines of Italy will naturally see a greater demand and sharp rises in their consumption all across the board.

It is clear that China has only begun to make itself felt. Data shows that markets until now have focused on the purchase of necessities. However, as we transit towards a consumption of small luxuries from greater discretionary income, markets will develop and become more sophisticated as a result. The potential is staggering.

How to achieve success in China? To begin with, a key element of any marketing strategy is to develop an international distribution. For this reason alone, Italian wineries must consider China as a key area of concern. However, key to success in any market is trust which is based on building strong relationships. The key is to go slowly and time is on the side of Italian wineries as the windows of real opportunities is forecasted to open within 6 to 10 years. But work is required now to slowly move out of obscurity and anonymity. With a long-term view, 2 main strategies are recommended: prioritized targeting and relationship building.

Considering graphic 6, it would be critical to become familiar with the particularities of each city clusters as defined by McKinsey & Company in order to prioritize targets of interest. The priority would be to focus on a limited number of clusters within a narrow target segment and build a scale across several cities within the same cluster. This would not only ensure that marketing budgets are used efficiently, but help achieve more sustainable results in the second part of the strategy which is to build strong and sustainable relationships.

In fact, key to any business dealings in China is “guanxi”. Unfortunately, the words has a bad reputation in the western world as it is often associated with corruption. But”, in reality, the word has a meaning beyond that of mere relationships. It refers to mutual obligations, reciprocity, and trust. Two approaches are necessary to build guanxi in China. First is brand building at home and in international markets outside of China by developing a strong value proposition with a single message. As we have seen, the upper-middle class is increasingly aspirational and key to satisfy those aspirations is prestige. By developing a strong image that encourage word of mouth referral and deep emotional associations, a brand will be in a stronger position to establish sustainable relationships with consumers. Second is to build human contacts with various stakeholders both at the trade and the consumer levels. Regular visits to China are critical not only to understand better the dynamics of the market clusters but also to develop a network of contacts with the key trade players. Mere participation to trade shows is not enough, wine dinners, interactions with sommeliers and various trade missions are necessary. Beyond the trade, relationships with consumers can immediately start to be developed through tourism. Indeed, the increasing number of globetrotting shoppers from China offer an invaluable opportunity to build emotional connections for purchase on the spot and also for them to influence friends when they return home. The retails environment of duty-free shopping as well as winery tours are perfect environment to provide consumers with the unique experiences and shopping entertainment that Chinese consumers are increasingly seeking. Finally, building CRM excellence is a critical key to strengthen these relationships. Through digital marketing and engagement via the help of email services, social media, blogs, and e-commerce a wine company can make a huge huge inroads in building the guanxi required to be successful in China.

The upper middle class is key to China’s future. By 2020, it will be its engine of growth and will be comprised of sophisticated and seasoned shoppers who resemble nothing of today’s consumers. They will be discerning and demanding and will be willing to pay a premium for quality. This will stimulate growth in luxury goods and overseas travel and will require major paradigm shifts in business strategies and approaches to markets. The key to success in China will be to establish guanxi and prioritize where to invest resources. Italian wineries have tremendous potential in the markets of China, but need to start working today in order to fully take advantage of the real window of opportunity that will open in 2020 and beyond.